Our Views

Celebrating the season of charitable giving – Part 3

10/23/2019

Advantages of donating securities through a corporation

In last week’s post, we examined the comparative benefits of making charitable donations of cash versus securities with an accrued capital gain. The short answer: from a tax perspective, it’s far more efficient to make donations of securities rather than cash.

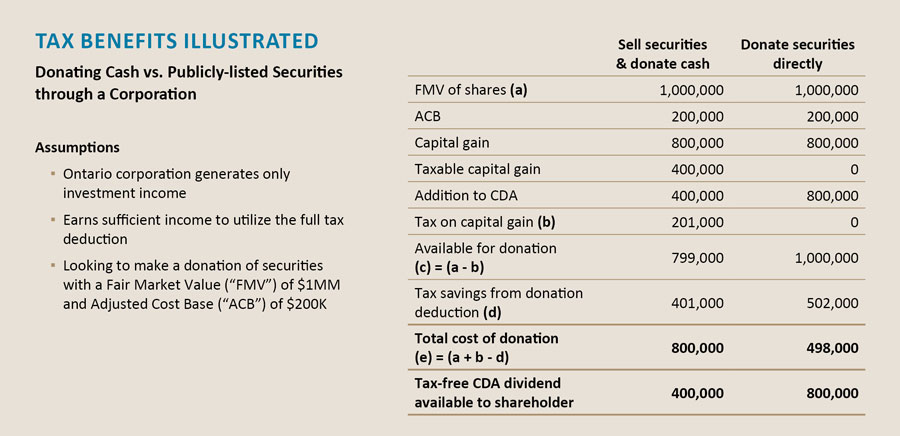

In today’s post, we explore the tax implications of making donations through an investment holding corporation — as many of our clients have established similar structures. Different tax treatment applies, depending on the type of donations.

A corporation would receive a tax deduction (vs. tax credit), which would reduce taxable income. Furthermore, the donation of publicly-listed securities through a corporation not only eliminates tax on the accrued gain, but also results in the entire capital gain being added to the Capital Dividend Account (CDA). The balance of the CDA can be withdrawn by a shareholder free of tax.

The following example illustrates tax consequences, resulting from a corporation selling securities and donating the after-tax proceeds versus donating the securities directly.

Based on the example above, donating securities directly is again the most tax efficient option. In addition to avoiding tax on accrued capital gain and generating a tax deduction, the shareholder can receive a significant amount of tax-free capital dividends from the corporation.

Donating securities through a corporation has important planning implications:

- Payment of capital dividends reduces the overall FMV of the corporation, which in turn lowers the potential estate tax liability.

- The overall donation cost is greatly reduced when considering the value of corporate tax deduction, CDA and lower estate taxes.

If you would like to discuss these tax benefits, feel free to get in touch.

Subscribe to Our Views

*Please refer to our Privacy Policy to find out how we protect your information