Our Views

How to manage “sequence of return” risk in retirement

08/20/2020

For high net-worth retirees, the risk of depleting their capital in their living years is sometimes a source of anxiety, no matter how wealthy they may be. This anxiety is heightened during periods of volatility when portfolios are down and their withdrawals take a proportionately bigger piece of the pie.

That’s because challenging market events – think the Financial Crisis of 2008 or the COVID-19 pandemic—that happen at the beginning of a retirement or investment period can have a major impact on your long-term financial standing when coupled with sustained withdrawals. It’s what is known in the industry as “sequence of return” risk. Fortunately, there are ways to manage this, which we’ll outline in this blog post.

“Most retirees need regular income from their portfolio to fund their living expenses. Withdrawing income reduces growth, and this becomes exaggerated when negative returns occur early in retirement versus in later years,” explains Newport Portfolio Manager Jordan Schwann.

What is often overlooked is how managing sequence of return risk can help allay concerns. Carefully managing the timing and nature of your retirement transition, how your lifestyle needs are funded and how your portfolio is built to deliver consistent cash flow, are key to providing golden-year peace of mind. Something that we take very seriously at Newport.

How sequencing works

Every investor has different financial goals in retirement.

It could be that you hope to preserve capital and leave a legacy for your loved ones or favourite charities. Maybe you like the idea of maintaining a portfolio with a hefty dollar value, or you genuinely fear running out of money.

That last concern matters for anyone at or near retirement as we emerge from the longest bull market in history and into the highly uncertain economic environment of the COVID-19 era.

Regardless, the math is straightforward for high net-worth individuals who plan to draw on their portfolio for a retirement income: the more your capital can grow in the early stages of retirement, the longer that capital base is likely to compound and sustain your retirement funding needs.

“Generating cash for retirement needs may require selling investments inside the portfolio. If these investments are sold when valuations are lower, it diminishes the value of the portfolio to a greater degree, making it more difficult to recapture over time,” Schwann says.

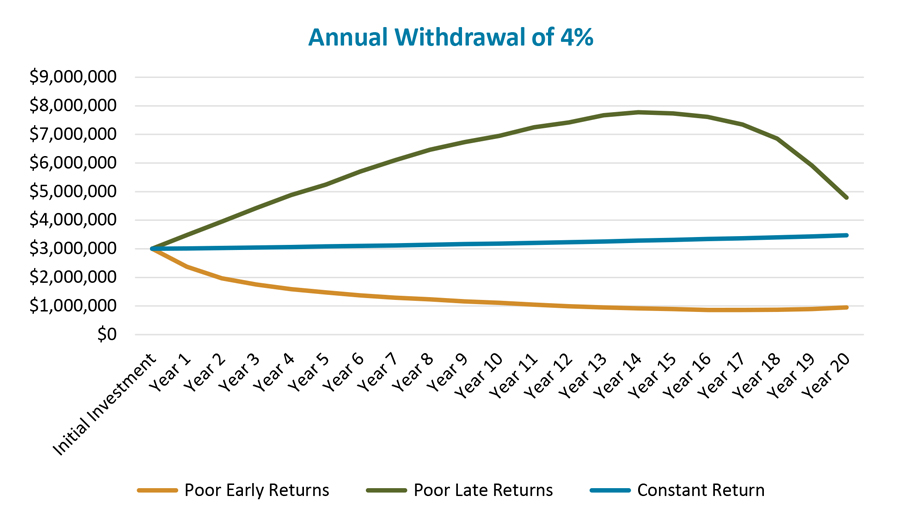

As illustrated in the chart below, poor returns early in retirement can diminish the long-term value of a portfolio significantly. In this model, we’ve assumed a $3 million portfolio capital base, an average annual rate of return of 5 per cent and annual withdrawals of $120,000. In the first scenario, we have assumed poor returns early in retirement – with the result being a portfolio worth just $951,333 after 20 years. Contrast this with a scenario in which poor returns occurred later in retirement, the ending portfolio value would be $4,788,554. A constant return profile would result in an ending value of $3,470,571. No wonder this is a big swing factor in financial portfolios.

Be strategic about how you retire

While you may not be able to control macroeconomic conditions, you may have control over how and when you decide to call it a career.

If that happens to be in a low or negative return environment, then it could make sense to delay retirement or consider consulting, sitting on an advisory board or working part-time to mitigate sequence of return risk and delay drawing savings in the near term.

It might even result in a more satisfying retirement transition.

“We find the happiest clients are those that do it gradually and continue doing some form of work,” says Mark Kinney, Newport’s Co-founder and Chief Investment Officer. “If you have a $4 million portfolio and can earn $100,000 a year from work, that’s equivalent to a 2.5 per cent return that can help you avoid drawing down on your portfolio.”

That was the case for Robert, a Newport client and a former retail chain franchisee, who retired in 2011. He took five years to plan his retirement in stages to ensure that he gradually eased out of the business, and in doing so, managed to avoid the worst of the market fallout from the financial crisis of 2008/09.

“The advantage we had going into retirement is that we could plan and everything was paid for,” he says. “Now we’re able to live comfortably and can take income we want from our investments. That’s allowed us to ski out West, take biking trips in Europe and enjoy ourselves.”

Project cash flows with confidence and invest for cash flow

As Schwann noted in our previous blog, traditional portfolio projections that make withdrawal and return assumptions based on annual averages are unrealistic in a time of heightened uncertainty.

Instead, we build volatility scenarios into our portfolio projections, all to help clients understand their financial situation and budget accordingly. We then revisit the plan every couple of years to make sure everything is on track and make any adjustments if needed.

“Some clients will look at the lower probability outcomes that show them potentially running out of money sooner, and that pushes them to look at their planning and spending rates to help them minimize the likelihood of those events,” he explains.

Perhaps most important, we aim to construct a reduced-volatility portfolio that delivers stable returns from cash flow such as interest, dividends, rental income—in our case through asset class and manager diversification and investments in private and alternative vehicles. This helps to generate periodic cash flow similar to regular employment income.

This is similar to the “Steady Eddie” approach of large pension funds, like the Canada Pension Plan for example.

A lower volatility, income focused portfolio helps avoid capital erosion in challenging market conditions. Projecting capital expenditures such as travel, home or car purchases and timing them according to the market can also help preserve your portfolio’s capital base.

In the end, it’s important to remember that protecting your wealth is not only about how much you withdraw from your portfolio, but when. Taking sequence-of-return risk into account can help you enjoy a happy retirement with less worry.

Subscribe to Our Views

*Please refer to our Privacy Policy to find out how we protect your information