Our Views

Q3 2022 – The Quarter That Was

11/19/2022

Reflections on a Wild Ride

Download PDF: Q3-2022 The Quarter That Was

Download PDF: Q3-2022 The Quarter That Was

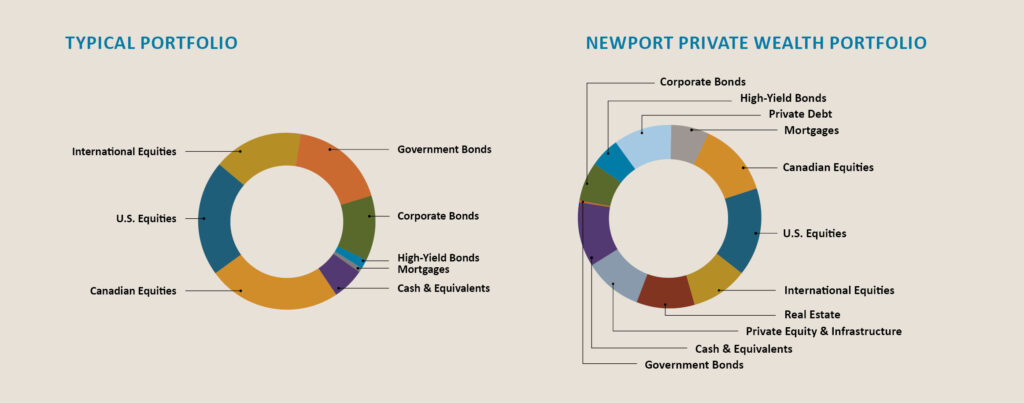

As investors grapple with the right strategy to protect themselves in volatile markets, the typical 60/40 portfolio has taken a beating. Newport’s view is that a diversification strategy is the best approach, no matter the markets conditions. Read on to see our take on the quarter that was, what we’ve invested in, and why alternative assets protect hard-earned capital in times like these.

That escalated quickly

Regardless of what happens for the balance of the year, Q3 2022 was one for the record books.

In fact, the whole of 2022 will be remembered as a year of change, challenge, and opportunity. Inflation jumped to levels last experienced in the early 1980s. In response, central banks aggressively increased interest rates to combat rising prices. There are always concerns that higher interest rates will slow the economy, hurt corporate earnings and weigh on share prices. Bond prices move in the opposite direction of interest rates, which makes increases unkind to this asset class.

In true textbook form, all of this played out in the third quarter. Global equity indices were down anywhere from 10-30% year-to-date and bonds sold off like an out of favour junior mining company. Both asset classes are on pace for one of their worst years ever.

A tough time for stock-and-bond-only investors

The typical “balanced” mutual fund sold by a bank or an insurance company was down anywhere from 13-18% through the end of Q3 2022. To make matters worse, most mutual funds are “all-in, all-the-time”, as cash balances are typically mandated to remain close to 0%.

When only two asset classes can be owned and they move in the wrong direction at the same time, it’s easy to get painted into a corner. Cash balance restrictions make things worse by removing the ability to manage risk and make opportunistic purchases. Fortunately, Newport is not bound by such constraints.

The benefits of asset class diversification

While Newport is not immune from market turbulence, investments in eleven public and private asset classes provide a different experience for our clients. Simply put, we have more ways to protect and grow your wealth.

Our third quarter performance provides a real time example. After an early summer rally, the S&P 500 sold off more than 9% in September. This marked the worst month for the Index since the pandemic-related sell-off in March 2020, and its worst September since 2002.

Despite this, all five of Newport’s client mandates posted positive results in the third quarter. With approximately 35% weighting in institutional private investments, we showcased our ability to generate growth and income that’s largely uncorrelated to the public markets.

Seeing opportunities in chaos

It is wise to, “buy when others are selling”, but for many, this is easier said than done. The urge to capitulate in the face of uncertainty overwhelms many investors.

It is also easy to get scared into a form of “analysis-paralysis”, which makes spectators out of would-be investors.

Newport doesn’t operate in this manner. We’re not constrained in our ability to raise and hold cash and we always employ an active approach to investing. Market selloffs are viewed as opportunities to make investment decisions that will create value and drive long-term performance.

“We remain in absolute control of our decision-making process, and

we have purposely built our mandates to withstand tough environments.”

While still operating with a healthy dose of caution, we maintain an appetite for investments with the ability to provide long-term wealth creation.

Take real estate. The broad portfolio of public and private real estate that Newport owns is key to our long-term diversification strategy. Unlike residential real estate, which has been impacted by falling prices and softening demand, this alternative asset class provides reliable income, cash flow and flexibility. Multi-family residential holdings are a key component of the portfolio and have stood up well under difficult conditions.

When it comes to equity markets, we don’t believe in participation at any cost. The third quarter saw us make small but consistent allocations to our public equity managers to keep weightings at the lower end of our target ranges. This allows us to use our liquidity as purchasing power. Our goal is to participate in up markets and protect in down markets.

We’re selective in what we add and build liquidity to be ready in times of stress. This allows us to grow cash balances and position portfolios defensively when needed.

What about the bond market? With most bond indices posting negative returns for the third quarter, the sector is on pace for one of the worst years in history. It’s why we’re sticking to our strategy of maintaining a low exposure to public bonds. The bonds we hold are of high quality and low duration. With more interest hikes on the horizon, and cash on hand, we are content to wait for further downside before changing course.

What lies ahead is anybody’s guess.

We would love to see a fourth quarter rally in equities and bonds but despite our best efforts, we continue to have zero control over the direction of the markets and the economy. However, we remain in absolute control of our decision-making process, and we have purposely built our mandates to withstand tough environments.

Our job is not to try and forecast our way to good performance based on today’s news. Performance is the result of long-term decision making; results are not dependent on outsized risk taking; and our process will not be abandoned to chase short term performance.

To find out more about Newport’s unique investment approach, get in touch.

Subscribe to Our Views

*Please refer to our Privacy Policy to find out how we protect your information