Our Views

Celebrating the season of charitable giving – Part 2

10/18/2019

Last week in this blog, we introduced the concept of charitable giving through a Foundation Account at Canada Gives. As promised, this week we look at the tax benefits of donating securities versus cash – whether it is to your own private foundation, a Foundation Account at Canada Gives or direct to charities.

Individuals who make donations to qualified charities receive a donation tax credit. This credit can be applied against the tax bill and can be worth up to approximately 50% of the donation. Generally, the total amount of donations that can be claimed for tax purposes cannot exceed 75% of net income (except for the year of death or preceding year, when the limit is 100% of net income). Furthermore, unused donations can be carried forward up to 5 years and claimed as a credit by either spouse in a household.

There are additional tax benefits if you donate publicly-listed securities as opposed to cash. Donations of publicly-listed securities do not result in a taxable capital gain to the donor and as such, the tax on accrued capital gain can be avoided.

Some common examples of publicly-listed securities include:

- A share, debt obligation or right listed on a prescribed stock exchange

- A share of the capital stock of a mutual fund corporation

- A unit of a mutual fund trust

Advantages of donating securities personally

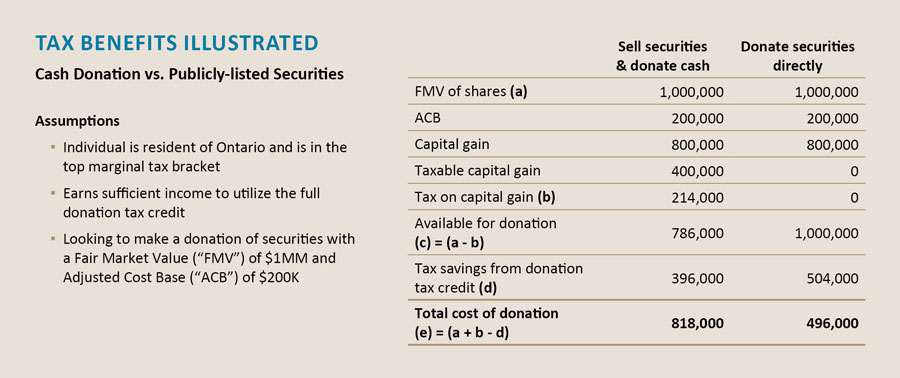

Below is a comparison of tax consequences resulting from an individual selling securities and donating the after-tax proceeds versus donating the securities directly.

Results presented in the table above indicate that donating securities directly is more tax efficient as opposed to after-tax cash proceeds on the sale of such securities. This is because there is a significant tax advantage resulting from avoiding the tax on accrued capital gain.

In light of these results, there are several planning points that should be considered:

- If you hold appreciated securities with upside potential, consider donating the securities and then immediately repurchasing them. This would eliminate the tax on capital gains, generate a donation tax credit and step up the cost base.

- If you hold securities with accrued losses, consider selling the securities and donating the cash proceeds. In addition to the donation tax credit, this would trigger capital losses, which can be applied against capital gains realized in the past 3 years or carried forward indefinitely. If you decide to re-acquire the shares, you must wait at least 30 days in order to avoid adverse tax consequences.

- If you have a large concentrated position with a low adjusted cost base, consider donating a portion of your holdings to reduce your tax bill by generating a donation tax credit.

Next week, we will examine the advantages of donating publicly-listed securities through a corporation.

If you would like to further discuss these tax benefits, feel free to get in touch.

Subscribe to Our Views

*Please refer to our Privacy Policy to find out how we protect your information