Our Views

Tax-effective strategies to withdraw funds for your retirement

08/06/2020

One of the most common questions we are asked by people who are either approaching or in the early stage of retirement is, “how should I structure my withdrawals to be most tax efficient?”

That question is even more pressing at a time when the COVID-19 crisis has prompted many high net-worth individuals to consider early retirement.

The answer may seem relatively straightforward, but as with any financial matter, it can depend on a retiree’s unique circumstances, their retirement goals, sources of income and expected marginal tax rates. In other words, there’s a great number of factors to consider.

The general rule of thumb

The general rule of thumb is to draw from non-registered accounts first, then your tax-free savings account (TFSA) and, lastly, your registered accounts. There are several reasons why, but before we look at the optimal withdrawal order, it’s important to understand how income from different sources is taxed. It’s only then that you can maximize your after-tax retirement income.

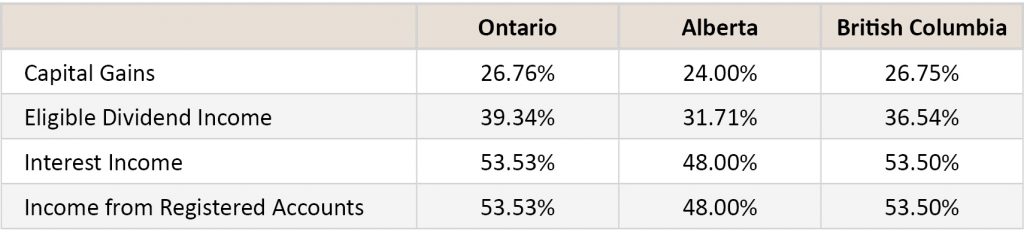

For example, residents of Ontario, Alberta, and British Columbia who are subject to the highest marginal tax rates—or annual incomes of $220,001, $314,928, and $220,001, respectively—will be subject to the following marginal tax rates:

Consider the tax implications

If you retire early, your non-registered/investment account is the first bucket you may want to consider withdrawing from. If properly structured and with tax efficiency in mind, you can receive income such as Canadian dividends and capital gains that both have preferential tax treatment, as shown in the table above.

The second withdrawal option is your TFSA—where growth and withdrawals are tax-free. In early and late retirement, a TFSA is considered one of the most flexible buckets from which to draw and supplement your income. Not only can you withdraw from your TFSA without triggering any capital gains, but you can also avoid impacting federally-sponsored benefits such as Old Age Security (OAS) through clawbacks when your net income is at $79,054 or higher, for 2020.

However, the drawback of consistently withdrawing from your TFSA account is that you’ll forego the lucrative tax-free growth that you can build up over time. An additional benefit that many Canadians overlook is that, upon death, a TFSA can be transferred to your heirs tax-free. If tax-effective succession is a goal, then growing funds inside your TFSA for as long as possible can be an advisable move.

The last bucket is your registered account—the RRSP. It’s important to remember that when you reach 72 years of age, mandatory RRIF withdrawals kick in. You’ll be required to withdraw minimum RRIF amounts regardless of the sources of income you’re receiving. The minimum RRIF withdrawal at 72 is 5.40%, increasing to 20% at age 95 and above for 2020.

When withdrawing from registered accounts makes sense

Income from registered accounts is taxed as ordinary income; therefore, it’s considered one of the least tax-efficient income sources. However, if you are 65 years or older and have a spouse in a lower tax bracket, you have the opportunity to income split with your spouse and lower your total household tax bill.

Some might argue that taking early RRSP withdrawals is a good strategy to reduce the total size of the RRIF account and lower the total tax bill by age 72 (and from that moment onward). But for this strategy to be beneficial, you need to be in a lower marginal tax bracket.

However, the trade-off is foregoing years of tax-deferred compounded growth and running the risk of outliving your savings as life expectancies continue to rise. Alternatively, if you extend the time period of your RRSP/RRIF withdrawal, let’s say for fear of depleting your assets, and you have no spouse or common-law partner, dependent child or an infirm child, upon death registered accounts could be subject to a 53.3% tax bill.

Customize the strategy to fit your retirement

That’s why the best income withdrawal strategy is the one that suits your personal financial situation and retirement aspirations.

Work with your tax advisor and financial planner to develop a plan that makes sense now, and be prepared to revise it as your goals or financial situation change in the years ahead.

Doing so will help position you and your family for prosperity, protect your wealth and provide the kind of certainty you need to live a wonderful post-retirement life.

A good starting point is to have a comprehensive retirement plan in place, assuming you don’t already have one. It will not only provide a roadmap to help you and your financial team set achievable portfolio growth targets, but will also provide peace of mind knowing that you have a clear strategy to guide your golden-year financial decisions.

If you would like to discuss how to structure your withdrawals effectively from a tax perspective, feel free to get in touch.

Subscribe to Our Views

*Please refer to our Privacy Policy to find out how we protect your information